Online RD in post office : An online recurring deposit (RD) account in the post office offers a convenient way to save money systematically over a fixed period, earning interest on the accumulated balance. This process is streamlined through the Department of Posts’ digital platform, making it easier for individuals to manage their savings without frequent visits to the post office. Here’s a comprehensive guide on how to open and manage an online RD account in the post office, including its benefits, eligibility, and step-by-step instructions.

What is a Recurring Deposit (RD)?

A Recurring Deposit is a financial instrument that allows individuals to deposit a fixed amount of money every month into their RD account. It’s an ideal savings tool for people with regular incomes, offering them a disciplined approach to saving. Over time, the small, regular deposits accumulate into a significant amount, which earns interest, helping the depositor to meet future financial goals.

Benefits of Opening an Online RD Account

Opening an RD account online through the post office has several advantages:

- Convenience: The entire process can be completed from the comfort of your home. You no longer need to visit the post office, stand in queues, or fill out paper forms.

- Accessibility: The online platform is accessible 24/7, allowing you to manage your RD account at your convenience.

- Automated Deposits: You can set up standing instructions for automatic transfers from your savings account to your RD account, ensuring timely deposits.

- Transparency: The online platform provides real-time updates on your account balance, transactions, and accrued interest.

- Security: Transactions conducted through the official post office portal are secure, ensuring the safety of your funds.

Eligibility Criteria for Opening an Online RD Account

To open an RD account online in the post office, you must meet the following eligibility criteria:

- Resident Indian: The RD scheme is available only to Indian residents. Non-Resident Indians (NRIs) are not eligible.

- Age: The account can be opened by individuals aged 18 years and above. Minors can also open an RD account, but it must be operated by a guardian until the minor reaches the age of majority.

- Post Office Savings Account: You must have an active savings account in the post office, as the RD deposits are linked to this account for auto-debit transactions.

Documents Required for Opening an Online RD Account

The following documents are generally required to open an RD account online:

- Identity Proof: A government-issued ID such as an Aadhaar card, PAN card, passport, or voter ID.

- Address Proof: Proof of residence such as an Aadhaar card, utility bill, or rental agreement.

- Passport-sized Photograph: A recent photograph for account verification purposes.

- Post Office Savings Account Details: The savings account number and other relevant details for linking the RD account.

Step-by-Step Process to Open an Online RD Account

1. Register on the India Post Portal

- Visit the official India Post website or download the India Post Payments Bank (IPPB) mobile app.

- If you are a new user, register by providing your mobile number, email ID, and other required details.

- Create a secure password and set up a profile for easy access to various services.

2. Login to Your Account

- After registration, log in to your account using your credentials.

- Navigate to the ‘Recurring Deposit’ section from the dashboard.

3. Link Your Savings Account

- If you haven’t linked your post office savings account already, you will be prompted to do so.

- Enter your savings account number and other required details to establish the link.

4. Fill in RD Account Details

- Choose the amount you wish to deposit monthly. The minimum deposit amount is typically ₹10 per month, with no maximum limit.

- Select the tenure of the RD account, which can range from 5 years to 10 years.

5. Set Up Auto-Debit Instructions

- You can opt for automatic debit from your savings account on a monthly basis.

- Provide the date on which the amount should be debited every month.

- Review and confirm the details before proceeding.

6. Complete the Process

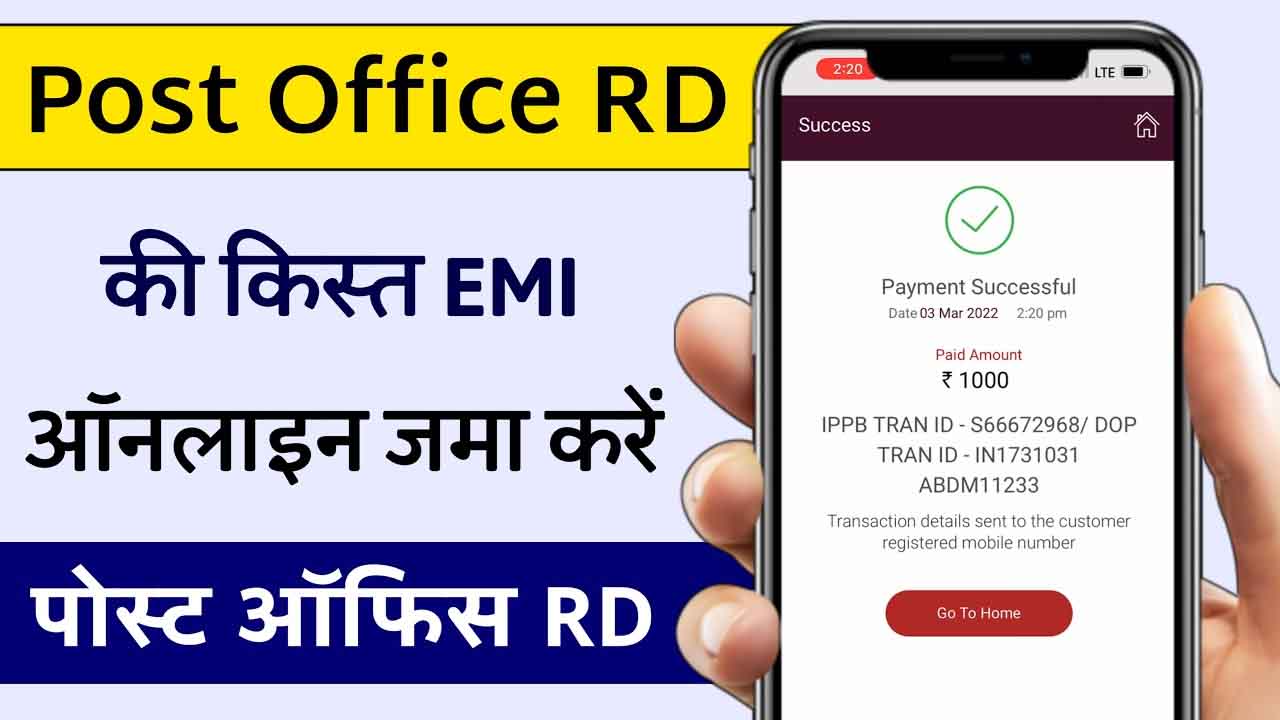

- Once you have filled in all the necessary details, submit the application.

- A confirmation message or email will be sent to your registered contact details, indicating that your RD account has been successfully opened.

Managing Your RD Account Online

After successfully opening your RD account, managing it online is straightforward. Here’s how you can do it:

- Track Your Account Balance: Log in to your account to check the current balance, recent transactions, and interest earned.

- Modify Auto-Debit Instructions: If you need to change the deposit amount or the debit date, you can do so through the online portal.

- Premature Closure: Although it is advisable to complete the full tenure to maximize your returns, the post office allows premature closure of RD accounts under specific conditions. However, this may result in a penalty or lower interest rates.

- Withdrawal on Maturity: Upon maturity, the accumulated amount, along with interest, will be credited to your linked savings account. You can opt for automatic transfer or withdraw the amount manually through the online platform.

- Renewal of RD Account: If you wish to continue saving, you can renew your RD account or open a new one with a different tenure.

Interest Rates and Tax Implications

The interest rate on post office RD accounts is determined by the government and is typically revised every quarter. The interest is compounded quarterly, providing substantial returns over the long term.

Regarding taxation, the interest earned on RD accounts is taxable under the “Income from Other Sources” category. The post office does not deduct TDS on RD interest, so it’s the account holder’s responsibility to declare the income while filing tax returns.

Opening an online RD account with the post office is a simple, secure, and efficient way to build your savings over time. With the ease of online management, it has become an increasingly popular choice for individuals seeking a disciplined approach to saving. By following the steps outlined in this guide, you can start your RD account seamlessly and manage it effectively, ensuring that your financial goals are met with minimal hassle.